Over the past five months, we’ve seen the retail apocalypse take shape at an unprecedented rate, with upwards of 12,000 retail stores closing, and 23 retailers filing for bankruptcy in 2020 so far.

Many of the traditional retailers filing for bankruptcy are not actually going out of business, but simply restructuring their debts with the promise of reinventing their strategy to come back stronger than ever. Retail execs love to use phrases like “shifting to eCommerce” and “developing a digital-first strategy”, but these strategies are far easier said than done.

There are a number of factors that make it nearly impossible for many legacy retailers to survive in the long term. I won’t talk about all of them today, but I’ll highlight the key themes that are driving the retail apocalypse.

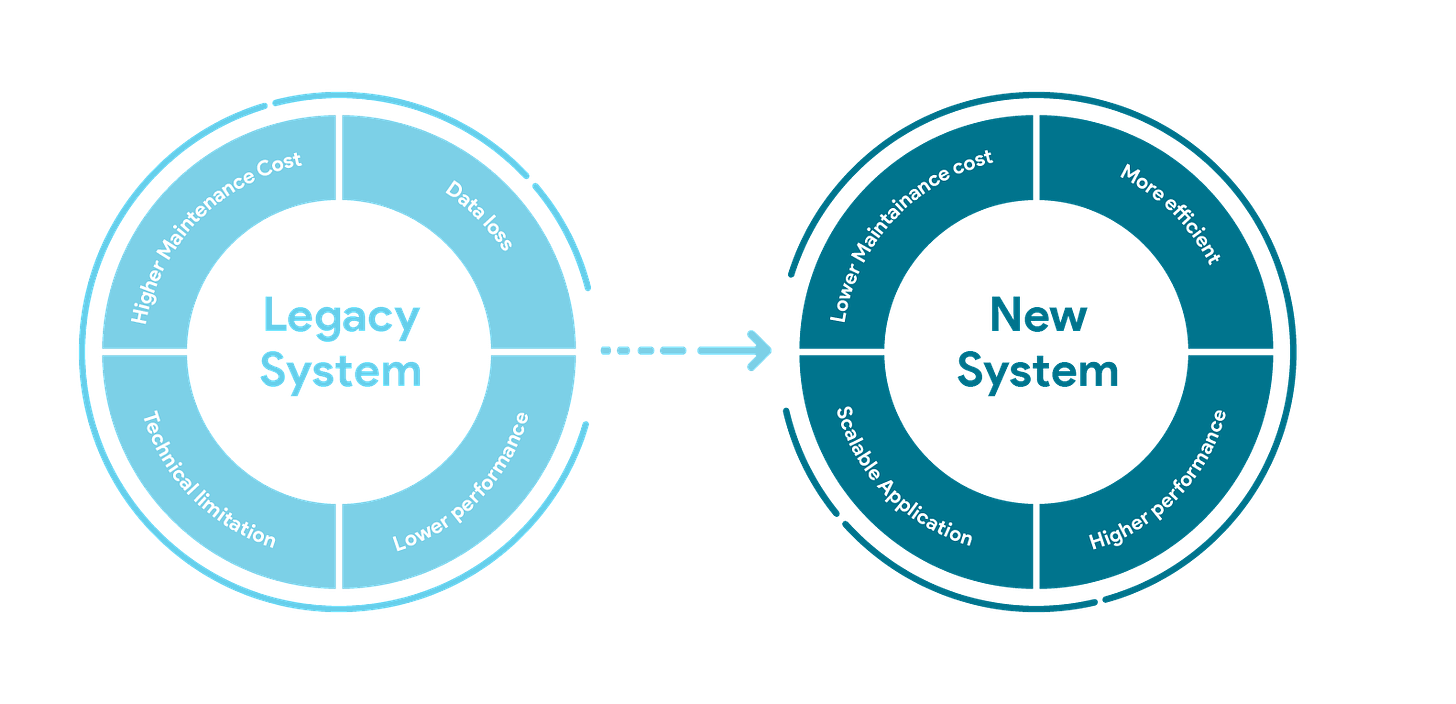

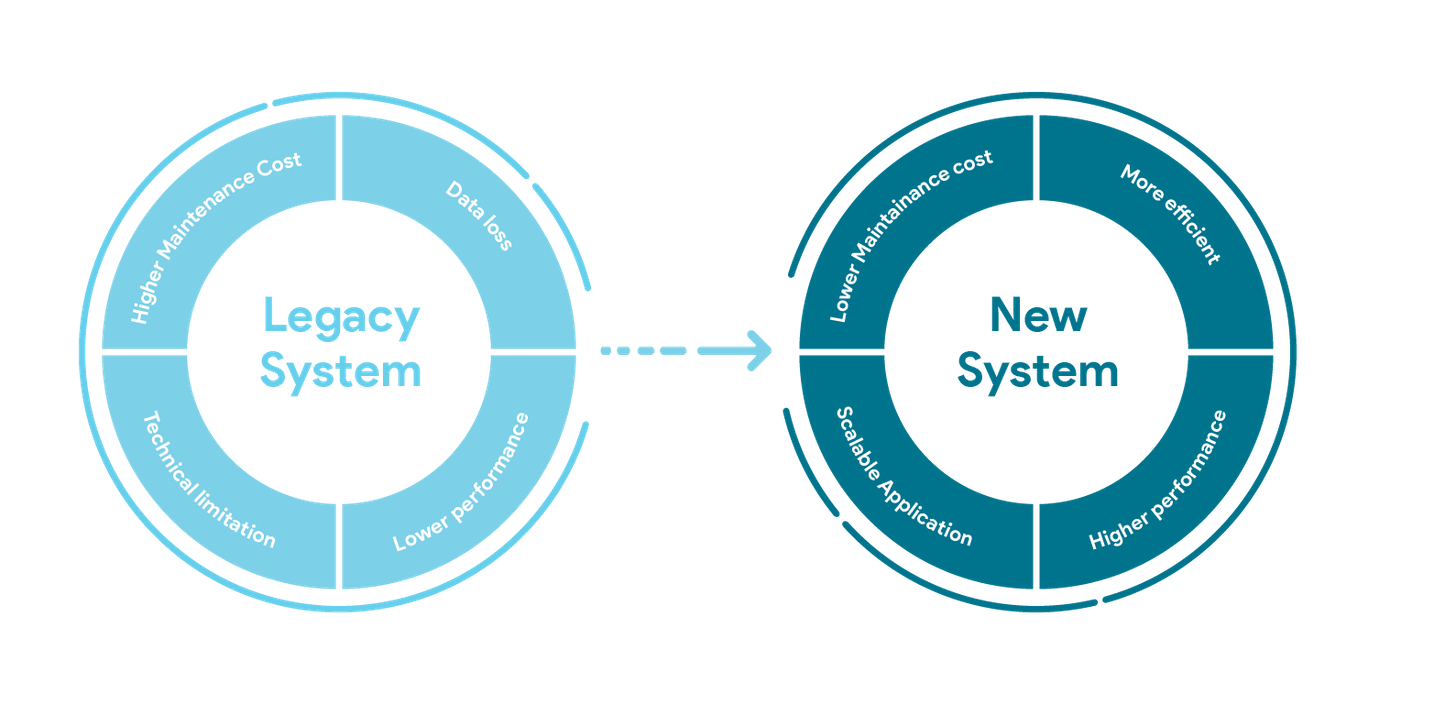

1. Outdated Technology Infrastructure

Of the four largest retailers in America (Walmart, Amazon, Kroger, & Costco), three of them were founded pre-internet.

Why does that matter?

Because when these companies were created, the foundational pillars of business, technology, and commerce were radically different than they are today.

These companies were built using outdated technology — before the cloud, eCommerce, email, etc. even existed! Of course, they have tried to update their technology, but the deep-rooted infrastructure is expensive and time-consuming to change.

These companies are the fortunate few who’s scale masks their inefficiencies. However, in a world where customers now expect things to be delivered to their doorstep overnight, this lack of flexibility, efficiency, and innovation is a growing competitive disadvantage relative to new digitally native companies.

2. High Costs

Traditional brick-and-mortar retailers have a number of fixed costs. They have to invest in real estate, inventory, sales associates, and supply chain just to keep their business afloat. The worst part is, these costs don’t decrease; even if revenues drop to zero during, let’s say, a pandemic.

On the other end of the spectrum, you have agile eCommerce companies running lean businesses with very little overhead costs. The internet has empowered small businesses and brands and given them the tools to scale in a less expensive and more efficient way.

While traditional retailers are attempting to cut costs by breaking leases and streamlining their supply chains, eCommerce is plowing forward and capturing their market share.

3. Consumer Disconnect

The modern consumer’s shopping habits have changed dramatically. We are seeing a massive shift towards digital with social discovery and shopping driving more purchases than ever before.

The type of mass marketing that traditional retailers built their businesses on doesn’t work in today’s digital economy. This is mainly because there’s no such mass-market anymore. The retail market is becoming incredibly fragmented, as small brands launch niche products for niche communities of consumers. There is a growing disconnect between what large retailers offer and what consumers want.

I don’t think that brick-and-mortar retail is dead. But I do think that in the future it will look VERY different than it does today and many of the big names in retail will disappear forever.

Retail + Tech News

- Background: Instagram released their newest video feature and TikTok competitor Instagram Reels. Reels looks an awful lot like Tiktok, so much so that the Tiktok CEO called facebook a “copycat”. This feature couldn’t have come at a better time; Trump just signed an executive order banning TikTok if they don’t sell to a US company within 45 days.

- Details: Reels has a similar “for you page” that you can access via your explore page that allows you to scroll through the most popular videos. It’s unclear if Instagram uses an algorithm to surface content to its users as TikTok does, and it is still missing some key features like the ability to duet. I personally feel like Instagram feels really busy and overwhelming now, but Zuckerberg wants to remain at the top of the social media game and he is going to make sure that happens.

Amazon Launches Retail Grocery Stores

- Background: Amazon has taken over a meaningful portion of the online grocery market with its online grocery sales tripling year-over-year as it inches closer towards Walmart. Now, the e-commerce giant rumored to be launching at least 15 new brick and mortar retail grocery stores under its ‘Amazon Fresh’ brand, creating a digitally-integrated experience that is unprecedented for the industry.

- Details: The grocery stores will have a one-way aisle to promote social distancing. But most importantly they will have a huge warehouse in the back and a designated area for curbside pick-up to help meet the demand for online grocery orders. The cherry on top is that the plan to integrate Alexa into this digital grocery experience to assist with grocery lists and scheduling deliveries.

“Customers will ask Alexa to buy grocery items and be delighted when she knows their favorite items, schedules deliveries, reminds them of items they may have forgotten, and helps them manage their household grocery needs.”

- Background: The e-commerce website Etsy that sells handmade, vintage, and craft supplies posted a huge quarterly profit. This was by far the biggest revenue growth the company has seen since the site launched in 2005.

- Details: Profits in Q2 rose 136.7% driven primarily by sales of home furniture and accessories and $346 million worth of masks. In addition to the massive earnings beat, Etsy also donated to a number of social and environmental issues.

- Background: While Uber’s core ridesharing business continues to struggle with the pandemic, the food delivery business has trimmed losses relative to the first quarter of the year.

- Details: While Uber’s continued losses are concerning, it is yet to be seen if they are building out a durable competitive advantage that could lead to future profitability. Uber is still investing heavily in building out core infrastructure to enter and grow in new markets such as food delivery.

Other News This Week:

Follow me on Social!

Xoxo Jackie

Recent Comments