👋 Hi friends, happy Friday! Welcome back to This Week in Retail.

Today we’re going to talk about one of my favorite articles of the entire year; The State of Fashion 2021 report by Mckinsey and Business of Fashion. You can read the full report here.

There’s bad. And then there’s really, really bad.

These are the two scenarios that The State of Fashion Annual Report, put out by Mckinsey and the Business of Fashion, layout for the fashion industry for 2021 and beyond.

With a blunt and quite objective tone, the report dives into what they call the “earlier recovery” scenario and the “later recovery” scenario.

1. “Earlier Recovery” Scenario

The first prediction is the best-case scenario. In this situation, they expect to see a return to normalcy in 2021, with global fashion sales down a mere 0-5% compared to 2019 levels. However, this scenario assumes a successful virus containment, rapid vaccine deployment, and a quick transition to economic recovery. Much of this is predicated on the government acting swiftly, efficiently, and cohesively. None of which they have proven to be capable of throughout this year.

2. “Later Recovery” Scenario

The second prediction is on the other end of the spectrum and lays out a worse-case outlook on recovery. In this scenario, the virus would continue to wreak havoc, further impacting demand, unemployment levels, and requiring additional lockdown orders. If this were to happen, they would expect sales growth to decline by 10-15% in 2021 compared to 2019 levels, and would not expect these numbers to normalize until the end of 2023. This is a very grim picture, indeed.

“In 2021, the COVID-19 pandemic will accelerate industry trends, with shopping shifting to digital channels and consumers continuing to champion fairness and social justice.”

It’s important to note that these scenarios are on two ends of a spectrum and that there could be any combination of outcomes in-between these two extremes. However, one thing is clear; the road to recovery is going to be a difficult one.

The Breakdown

The report is 65 pages long and goes in-depth on a number of different topics and variables that could impact the retail industry. Today I’m going to talk through three topics that I think are the most interesting from the report:

-

The Shift to Digital

-

Demand Constraints

-

Social Justice

1. Shift to Digital

The “shift to digital” might be the most used phrase in business in 2020. While this isn’t news to anyone, what’s interesting to note here is how to approach your digital presence. Because the entire world has now gone online, the competition is fierce. The noise in digital channels is unbearable and it’s more important than ever to have a clear and concise message to your customers.

Respect your customer’s time; make things obvious, let them know who and what your brand is upfront, and create a frictionless digital experience. On top of that, developing engaging social experiences for consumers to connect with your brand has become essential to standing out.

2. Demand Constraints

Consumer spending is unlikely to return to pre-pandemic levels until the end of 2021 at the very earliest, but it may take much longer than that.

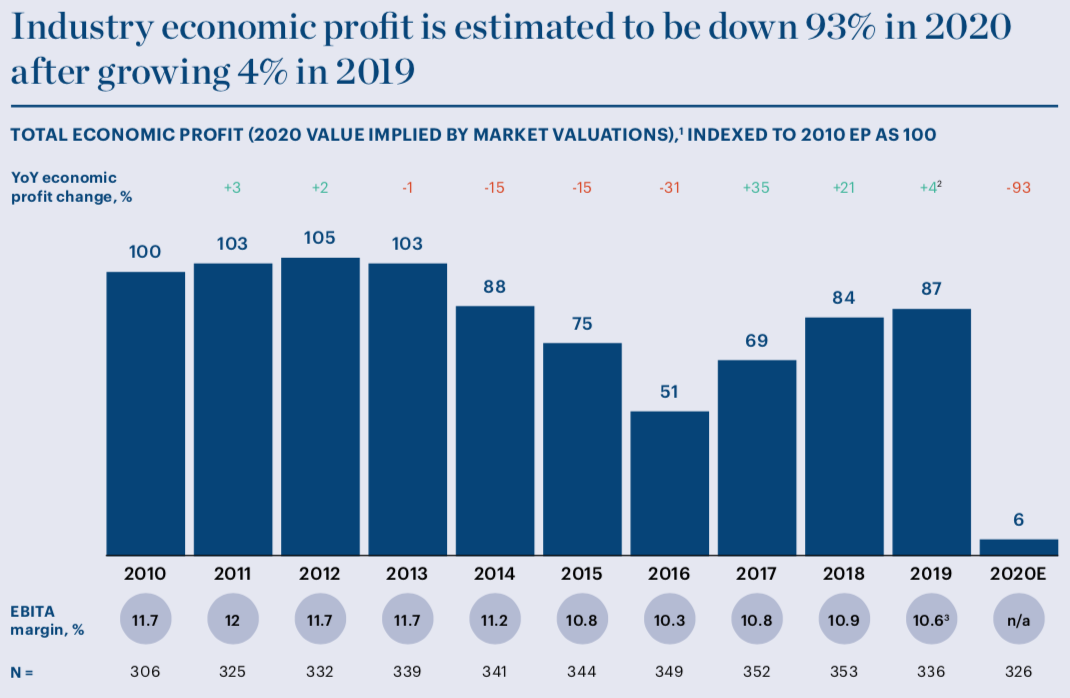

There is a negative feedback loop taking hold on our consumer economy. Rising unemployment, restrained spending power, and increasing inequality will continue to dimish demand for discretionary goods.

Amidst these challenging economic conditions, consumers are not only spending less, but are also questioning why they ever spent so much in the first place? Consumer culture is shifting from “more, more, more” to “less is more”.

“Undoubtedly the apparel market has shrunk in 2020. People aren’t shopping in stores— they’re sitting at home questioning why they have so many items in their closets,” said Elizabeth Spaulding, president of Stitch Fix.”

3. Social Justice

The pandemic has put a spotlight on the social injustices within fashion’s supply chain. From underpaid garment workers to massive environmental damage, consumers are now looking to brands to fix this incredibly broken and unjust web it has created.

In fact, 66% of consumers said they would stop or significantly reduce

shopping at a brand if they found it was not treating its employees or suppliers’ employees fairly.

Consumers will continue to demand more from brands in their engagement with socio-political values.

-

Online sales reach $10.8 billion on Cyber Monday: Holiday shoppers spent $10.8 billion on Cyber Monday, up 15.1% from a year ago, setting a record for the largest U.S. online shopping day ever. Shoppers started their gift buying earlier than ever, as retailers promoted deals in October.

-

Sephora will open mini shops inside 850 Kohl’s stores by 2023: Kohl’s hopes its Sephora partnership will help triple its sales in beauty in coming years. Retailers are looking toward the beauty category to build loyalty with customers. This is on the heels of Target recently partnering with Ulta to open makeup shops in the discount retailer’s stores.

-

‘Personalized gifts’ is the No. 1 search term on Etsy this year: Etsy searches for “personalized gifts” are even more popular than queries for face masks in 2020, CEO Josh Silverman told CNBC on Monday. Sales on the e-commerce site have surged in general this year during the coronavirus pandemic as consumer look to support local businesses.

Follow me on Social!

-Jackie

Recent Comments