Welcome back to This Week in Retail!

Thanks for following along, it means so much to me! If you like this post share it with someone who would also love it.

The Rise of Ecommerce

Retail has a long history of tightly holding on to the analog world. Relatively little innovation was happening in the space, and the adoption of new technologies by both companies and consumers was slow compared to the broader economy.

However, over the last eight months, we’ve seen eCommerce accelerate in ways that didn’t seem possible a year ago. E-commerce penetration is expected to grow to 19.2% of all US retail sales by 2024.

With this kind of massive growth comes immense financial opportunity. And as a result, new entrants have begun to flood the market in hopes of getting a slice of this future growth potential.

This is exactly what we’re seeing play out in the eCommerce space today. Overnight, eCommerce became the most lucrative channel in retail. Venture Capital firms are flocking to retail tech startups, legacy retailers are investing massive amounts of capital in backend eCommerce infrastructure, and new brands are leveraging eCommerce to grow at unprecedented rates.

Naturally, social media companies are increasing their presence to capitalize on the opportunity

Social + Commerce

Historically, social media platforms have generated revenue by selling advertisements. A few weeks ago in my newsletter, I talked about the algorithms that power the advertising arm of some of the largest social media platforms.

Now, with increased scrutiny around the transparency of highly targeted ads coupled with accusations of potential monopolistic business practices, social media platforms are looking to eCommerce as an additional revenue channel.

Instagram has been a pioneer in this as they just introduced their Instagram shop feature to help drive eCommerce conversion on its platform.

We’ve also seen Tiktok recently partner with Shopify to enable merchants to create and disseminate advertisements on their platform. Additionally, the viral video giant has explored integrating with Walmart’s eCommerce platform to further enable shopping on their app.

China & The Future of eCommerce

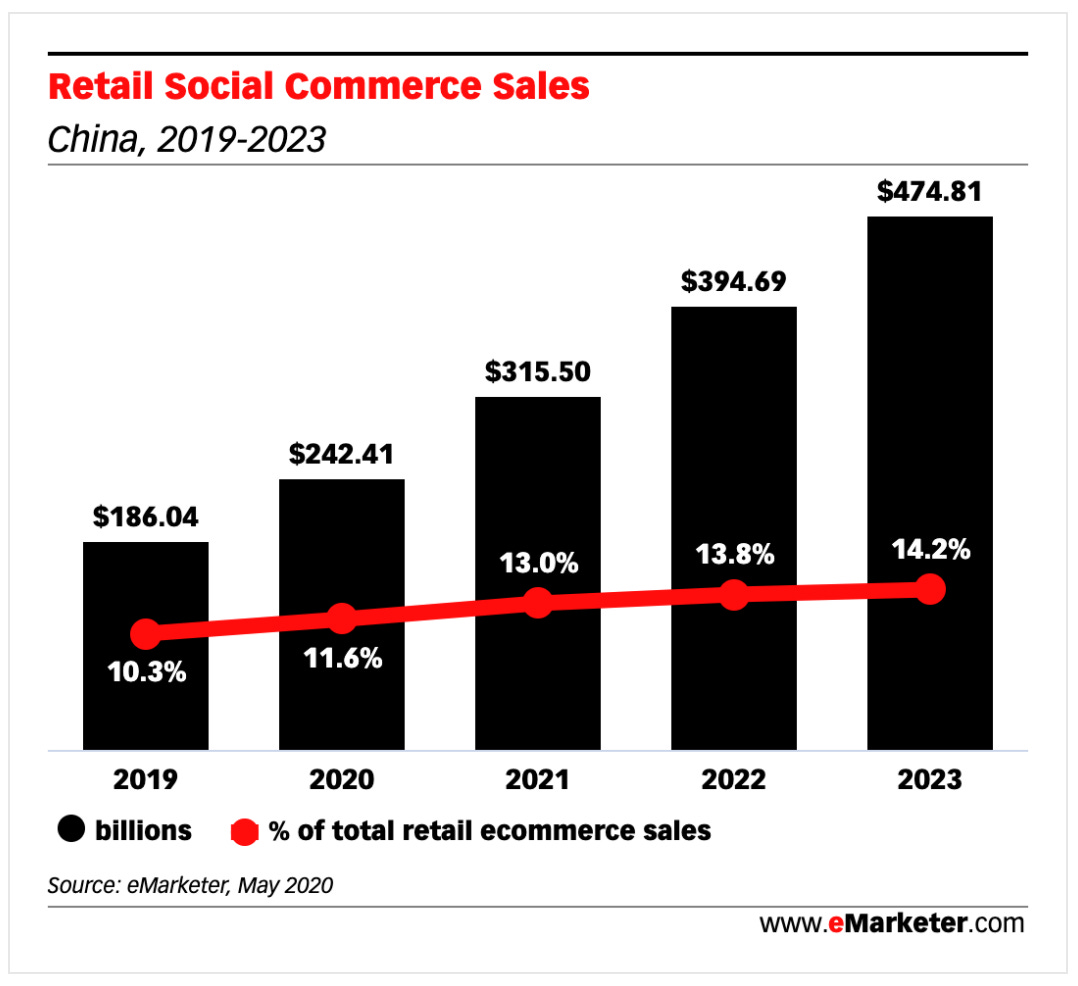

While social commerce is a newer phenomenon in the US, China has been an early adopter of this trend. In fact, social commerce in China is estimated to drive 14% of total eCommerce sales in China by 2023.

What’s interesting is how Chinese consumers view social shopping platforms as a form of entertainment rather than a means to an end.

Platforms like Alibaba, WeChat, and Pinduoduo have evolved into entertainment hubs for Chinese consumers. Alibaba provides the infrastructures to enable brands and retailers to connect directly with shoppers through games, videos, online communities, news, and even celebrity events and talk shows.

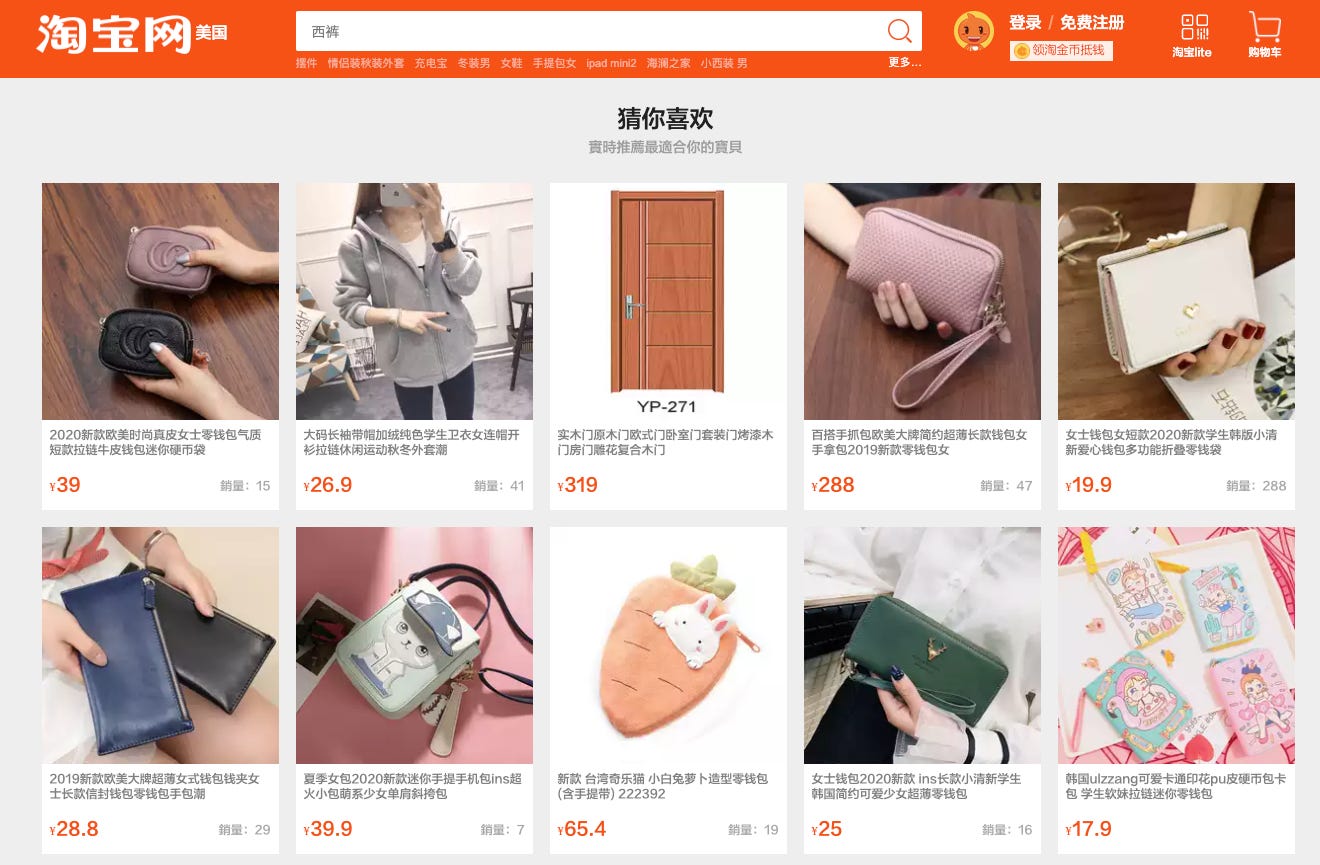

As a result, China’s consumers spend on average almost 30 minutes a day on Alibaba’s Taobao, nearly three times longer than the average US consumer spends on Amazon. The Chinese consumer considers Alibaba to be more of a “virtual mall” that they visit to first be entertained and then shop. In contrast, in the US consumers come to Amazon with the intent to purchase rather than to be entertained.

Photo: Alibaba’s Taobao

In China, these social shopping platforms have made online shopping an enjoyable pastime rather than a means to an end. I would expect a similar path to emerge on social media in the near future. Media will become the store.

But the question is; who will be the biggest winners?

The Rundown:

-

Tiktok Partners with Shopify: Shopify said on Tuesday it will partner with TikTok to help it’s one million+ merchants more easily advertise their products on the video-sharing app. The partnership will allow its merchants to sell products in the form of shoppable video ads, where TikTok users can click on an ad to buy the product.

-

Apple Explores Search: Apple has a growing interest in search technology and might even be working on a product to compete with Google. The most visible change is the fact that in iOS 14, Apple is now showing its own results when you type queries on the home screen. There may be more of an opportunity here as the U.S. Justice Department has sued Google over what it claims are anti-competitive behaviors around search.

-

Walmart Turns Four Stores Into eCommerce Laboratories: Walmart is turning four of its stores into laboratories that test ways to turn the company’s huge physical footprint into a more powerful edge for e-commerce.

At the stores, employees will use digital tools, store design features, and different strategies that could speed up restocking shelves and fulfilling online orders.

Even before the pandemic fueled e-commerce growth, the big-box retailer had made moves to align its online and e-commerce strategies — such as merging separate teams of buyers. -

Amazon’s Q3 Earnings: Amazon reported its third-quarter results after the closing bell on Thursday, soaring past analysts’ expectations for profit and sales, which grew 37% year over year. For the fourth quarter, Amazon forecast operating income to fall between $1 billion and $4.5 billion, assuming about $4 billion of costs tied to Covid-19.

Follow me on Social!

-Jackie

Recent Comments