Happy Friday!

I wanted to give a quick welcome to all of my new subscribers and say thank you to those of you who have been following me here for a while. I put a ton of work into this weekly newsletter and it means so much to me to have you all here.

If you know someone who would love this newsletter, please share it ou! I also always love to hear your feedback so feel free to respond to this email with any topics you’d like me to cover.

Next Friday’s newsletter will be a special edition newsletter. I am interviewing author Doug Stephen of Reengineering Retail next week so I will release my podcast and newsletter covering that interview on Friday. Get excited!

A House of Cards

There wasn’t one single thing that caused the 2008 financial collapse. Many experts will explain it as a “house of cards”, meaning that the entire system was fragile and was being propped up artificially. When that artificial bubble popped, the entire system came crashing down.

What we’re seeing play out in the retail space today is very similar in nature to the 2008 financial collapse.

Over the last decade, the retail industry, like the economy, has been artificially inflated. Retailers and brands were running at full speed. More clothes were being produced, purchased, and subsequently disposed of than ever before, and there was a constant push to make clothes cheaper. The retail ecosystem was unsustainable, and all it took was a global pandemic to expose the fragility.

The Giants Would Fall First

In February 2020, the novel Coronavirus hit the United States. The CDC and the federal government issued shelter-in-place orders beginning in early March, this total shutdown of the economy was the final straw for already struggling retailers.

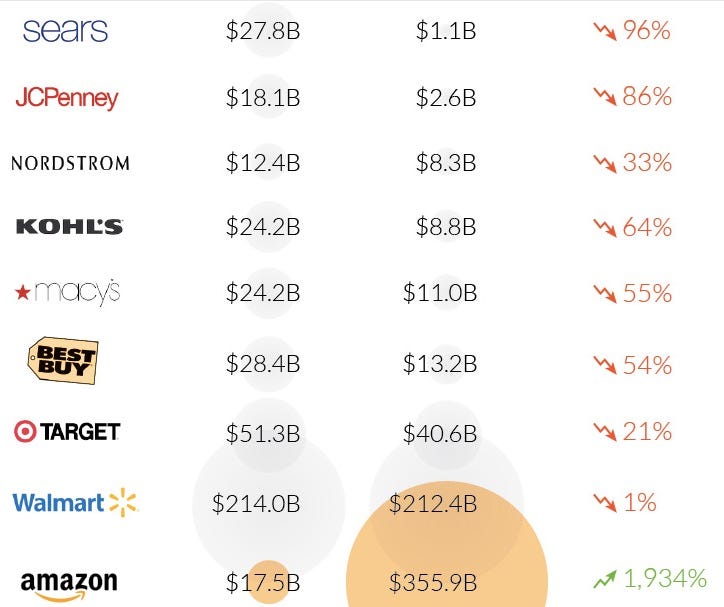

The giants in the retail industry would fall first. Their high fixes costs and bloated inventory couldn’t withstand a crisis of this magnitude.

Neiman Marcus, J.C. Penney’s, and J. Crew all filed for bankruptcy within the first two months of the lockdown. In the months following, 6,300 retail stores would close across the country. This is only the beginning.

The Breakdown

But how did we end up here?

There are a number of conflating forces that contributed to the demise of the traditional retail industry; let’s break them down.

1. Outsourcing Manufacturing

In 1960, about 95% of clothes purchased by US consumers were made in the USA. Fast forward to today, and less than 2% of the clothes purchased by US consumers are made in the US. The pandemic has exposed our over-reliance on China’s supply chain, especially within the fashion industry.

2. Surplus Inventory

As we outsourced our manufacturing to China, we were able to create cheaper goods, and thus produce more. Gone were the days of small, high-quality batches of products. Enter H&M, Zara, Old Navy, and other fast fashion houses who are focused on driving revenue through volume rather than traditional retail markups.

3. Perpetual Discounts

As the supply of goods increased, retailers needed to turn inventory faster to make room for the new products. Enter markdowns.

These weren’t your typical once a year sales. First, it was the half-yearly sale, then the sales were once a season, and before you knew it, sales were happening so often that consumers refused to buy items at full price. Retailers now had to discount products to sell anything.

5. Social Media & eCommerce

Alongside these systemic shifts, there was a broader social change taking shape. Social media had completely infiltrated the fashion world and was exposing consumers to fashion at all levels. High fashion became low fashion and vise versa.

Large retailers and brands no longer controlled the narrative, consumers did. Suddenly, the big players in the industry were playing catch up. In a desperate attempt to stay relevant, retailers and brands scrambled to create content, engage with influencers, and pumped money into digital channels. This sped up the fashion cycle even more, creating additional pressure to produce and sell goods.

6. The Real Problem

The real problem is, the growth required to support the fashion industry as it exists today is unsustainable. There are too many goods being produced relative to the number of consumers. We need to break the cycle, and that means more retailers will have to fall. As an industry, we will need to rethink fast fashion, and retail will need to go back to the basics, literally.

How do we rebuild a broken system?

Next week I’ll dive into how I think we can fix the industry from both a producer and consumer lense.

Retail + Tech News

Instagram Creates Suggested Post Feature

-

Background: In an attempt to keep up with Tiktok’s dynamic algorithm, Instagram has been trying to find new ways to connect its users with new content creators.

-

Details: Instagram announced that it will now include suggested posts from accounts you don’t follow to the bottom of your feed. According to Instagram, the suggested posts are not the same as the ones on a user’s explore page, as the suggested posts are more specifically targeted based on posts the person already engages with. But will this change keep users engaged for longer?

Spotify Releases ‘Virtual Events’ Feature

-

Background: Spotify will be releasing a new ‘virtual events’ feature that will appear on an artist’s home page to notify listeners of upcoming online performances.

-

Details: Spotify already works with Ticketmaster, Eventbrite, and other ticketing sites, which have all embraced virtual shows as a way to stay in business while in-person concerts are put on hold. The move serves Spotify’s goal of being the preferred streaming platform for artists since they are directly advertising these events to their listeners. Since concerts were a main source of revenue for artists before the lockdown, the music industry is hopeful that virtual concerts can now act as a replacement, at least temporarily.

TikTok Sues Trump Administration Over Ban

-

Background: Tik Tok filed a lawsuit claiming that Trump’s order to ban them violates due process protections. They also say that the ban offers no evidence for its claim that the app presents a national security threat and that the administration ignored Tik Tok’s efforts to address this concern.

-

Details: Tik Tok argues that the executive order is “not rooted in bona fide national security concerns”, and instead is a political move. The company points out that apps are typically exempt from sanctions, and Tik Tok is a means of communication that should be covered by the first amendment. Tik Tok additionally argues that Trump’s move was intended primarily to pressure the company to sell to Microsoft.

Traditional Retail News

Gap Reports Loss in Recent Earnings

-

Background: Gap has been one of the key retailers struggling during this pandemic, even Kanye West can’t save them! They just released their earnings and they were far from positive.

-

Details: Gap shared that its total sales tumbled 18% during the latest quarter, as e-commerce revenue surged 95% from a year ago, but those gains were offset by a 48% drop in-store sales during the coronavirus pandemic. The lower sales combined with additional shipping expenses for all of those online orders weighed on profits. From a brand perspective, Athleta was a bright spot as they offer athleisure & work from home appropriate clothes.

Follow me on Social!

Xoxo Jackie

Recent Comments